Reliance Health Insurance

The Reliance Health Insurance Company offers a wide range of customized health insurance policies that serves the best healthcare services inclusive o...Read More

Network hospitals

9100+

Claim settlement ratio

87.50%

Sum insured

Up to 5 Cr

No. of Plans

11Solvency Ratio

1.5

Pan India Presence

127+

Choose 1st Company

Choose 2nd Company

Compare

Best Selling Reliance Health Insurance Plans

Let's take a look at the list of health insurance plans that offer comprehensive protection to you and your family

-

Individual

Reliance Health Insurance Plans Eligibility Approximate Annual Premiums Reliance Hospi-Care Policy Entry Age - 18 to 65 years

Sum Insured - Up to 10 LRs. NA

Reliance Specially Abled Health Insurance Plan Entry Age - Child: 1 - 17 years, Adult: 18 - 65 years

Sum Insured - Up to 5 LRs. NA

-

Group Health Insurance

Reliance Health Insurance Plans Eligibility Approximate Annual Premiums Reliance Group Mediclaim Policy Entry Age - 18 to 65 years

Sum Insured - Up to NARs. NA

-

Critical Illness Health Insurance

Reliance Health Insurance Plans Eligibility Approximate Annual Premiums Reliance Critical Illness Insurance Entry Age - 18 to 65 Years

Sum Insured - Up to 10 LRs. 1369

-

Individual and Family Health Insurance

Reliance Health Insurance Plans Eligibility Approximate Annual Premiums Corona Kavach Plan Entry Age - Child Age: 1 day to 25 years, Adult Age: 18 to 65 years

Sum Insured - Up to 5 LRs. NA

Reliance Arogya Sanjeevani Plan Entry Age - Minimum 18 years, Maximum 65 years

Sum Insured - Up to 10 LRs. NA

-

Top Up and Super Top Up

Reliance Health Insurance Plans Eligibility Approximate Annual Premiums Reliance Super Top-Up Insurance Plan Entry Age - 18 – 65 Years

Sum Insured - Up to 1.3 CrRs. NA

Key Features Of Reliance Health Insurance

Let us take a look at some unique features of top-selling Reliance Health Insurance policies:

For Individual

Reliance Hospi-Care Policy

The Hospi-Care plan offers an emergency shield by covering your daily hospital cash expenses for listed illness treatments.

Why Do We Recommend This?

- 150+ listed surgeries

- 140+ daycare procedures

- Hospital daily allowance

For Group Health Insurance

Reliance Group Mediclaim Policy

Reliance Group Mediclaim Policy offers high-end healthcare services and tax exemption benefits to the corporate employees and a group of members under a club/society, etc, at an affordable premium price.

Why Do We Recommend This?

- Avail coverage benefits for daycare procedures

- Invaluable added benefit options

- Corporate employee benefits without paying out-of-pocket

For Critical Illness Health Insurance

Reliance Critical Illness Insurance

Reliance Critical Illness insurance plan offers healthcare expenses against 10 critical illnesses that disables you from leading a healthy and stress-free life.

Why Do We Recommend This?

- COVID-19 treatment cover

- Over 10 critical illnesses are covered

- Healthcare emergency services

For Individual and Family Health Insurance

Corona Kavach Plan

The Reliance Corona Kavach plan offers high-end coverage for corona treatment and all sorts of expenses related to care for the same.

Why Do We Recommend This?

- AYUSH treatment

- COVID-19 treatment expenses cover

- Domiciliary hospitalization and home care treatment

For Top Up and Super Top Up

Reliance Super Top-Up Insurance Plan

Reliance Health super top-up insurance has multiple coverage options such as inpatient care including ICU charges, diagnostic tests, pre and post-hospitalisation expenses, modern treatments like robotic surgeries, stem cell therapy, road ambulance services and more.

Why do we recommend this?

- Waiver of premium

- Worldwide emergency cover

- Tax benefits

Recommended Videos

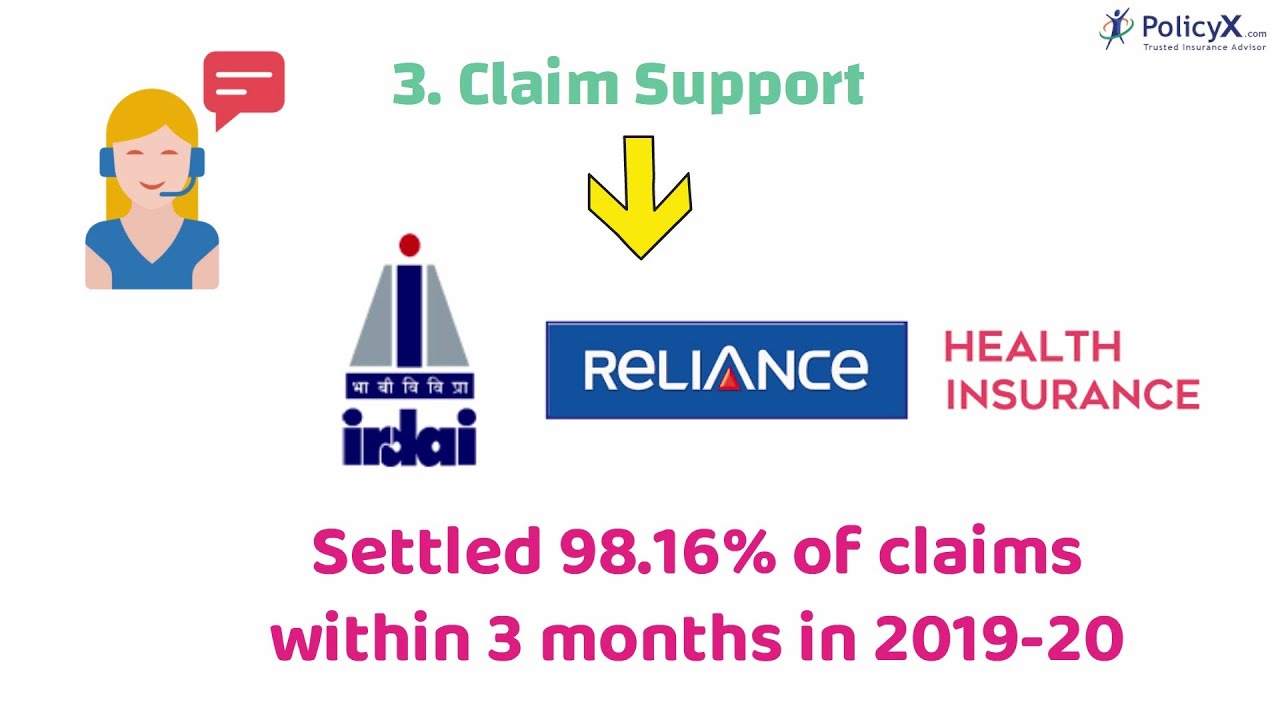

Why Choose Reliance Health?

- Versatile and affordable health insurance plans for every need

- 24X7 customer support for easy claim settlement

- Over 9100 network hospitals all over India

- Offers comprehensive coverage at affordable premiums

- Tax benefits under Section 80D of the Income Tax Act

Waiting Period in Reliance Health Insurance Company

The waiting period is the duration in which you have to wait before making the claim. This waiting period applies from the date you buy the policy and lasts up to 15 days to 4 years depending on the policy.

Reliance Health Insurance generally adds the following waiting periods:

Initial Waiting Period

This waiting period is experienced in the first 30 days from the policy commencements. You cannot file for a claim except for emergency hospitalization due to an accident.

Pre-existing Disease Waiting Period

As per IRDAI, pre-existing diseases are diseases that are diagnosed 48 months before you buy a health insurance plan. Diseases like diabetes, thyroid, hypertension, etc are some of the diseases in which waiting periods might occur.

Specific Diseases Waiting Period

This waiting period occurs for a few diseases like cataracts, ENT disorders, joint replacement surgery, mental illness, etc. The waiting period for these diseases can be up to 24 months depending on the type of plan you choose.

Maternity Benefit Waiting Period

Maternity benefits usually start after 1 to 4 years of waiting period after buying health insurance. However, it depends upon the policy. So, you need to plan your family accordingly.

Mental Illness Waiting Period

Today, many policies provide coverage for mental illness but you can avail claim after a specific time. Usually, the waiting period for mental illness coverage is 1 to 4 years.

Documents Required For Reliance Health Policy Claim Settlement

Submit the following documents when filing for Reliance health claims:

- Duly completed and signed claim form, in original

- Valid photo-ID proof

- Medical practitioner's referral letter and prescription

- Original bills, receipts, and discharge cards from the hospital/medical practitioner

- Original bills from pharmacy/chemists

- Original pathological/diagnostic tests reports/radiology reports and payment receipts

- Indoor case papers

- First Information Report, final police report, if applicable

- Post-mortem report, if conducted

- Any other document as required by the company to assess the claim

More Queries?

If you have any more queries regarding

Plans,

Renewals, or Claim Procedures, contact our insurance experts at:

1800-4200-269

now!

Other Health Insurance Companies

Compare mediclaim policies with other top insurers in India.

Know More About Health Insurance Companies

Share your Valuable Feedback

4.4

Rated by 2637 customers

Was the Information Helpful?

Select Your Rating

We would like to hear from you

Let us know about your experience or any feedback that might help us serve you better in future.

Written By: Simran Saxena

Simran has over 3 years of experience in content marketing, insurance, and healthcare sectors. Her motto to make health and term insurance simple for our readers has proven to make insurance lingos simple and easy to understand by our readers.

Reviewed By: Anchita Bhattacharyya

Reviewed By: Anchita Bhattacharyya

Do you have any thoughts you’d like to share?